The Clark Wealth Partners Statements

Clark Wealth Partners Fundamentals Explained

Table of ContentsGetting The Clark Wealth Partners To WorkThe Ultimate Guide To Clark Wealth Partners7 Easy Facts About Clark Wealth Partners ShownClark Wealth Partners - Questions4 Simple Techniques For Clark Wealth PartnersRumored Buzz on Clark Wealth PartnersAll about Clark Wealth Partners

The globe of money is a complicated one., for example, just recently discovered that almost two-thirds of Americans were not able to pass a standard, five-question monetary literacy examination that quizzed participants on topics such as rate of interest, financial debt, and other relatively basic principles.Along with managing their existing clients, financial experts will frequently spend a reasonable quantity of time weekly conference with potential customers and marketing their services to preserve and grow their business. For those taking into consideration ending up being a monetary expert, it is very important to take into consideration the average income and task security for those working in the field.

Programs in taxes, estate planning, financial investments, and threat monitoring can be practical for pupils on this course. Depending upon your distinct career objectives, you may also require to gain specific licenses to meet particular customers' needs, such as acquiring and selling supplies, bonds, and insurance plans. It can likewise be useful to gain a qualification such as a Certified Financial Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

Clark Wealth Partners Can Be Fun For Anyone

Many individuals choose to get help by utilizing the solutions of a monetary professional. What that looks like can be a number of things, and can vary depending on your age and phase of life. Before you do anything, research is key. Some individuals stress that they need a specific quantity of cash to spend before they can get aid from an expert.

Indicators on Clark Wealth Partners You Need To Know

If you have not had any kind of experience with a financial expert, below's what to expect: They'll begin by supplying a comprehensive evaluation of where you stand with your assets, responsibilities and whether you're satisfying benchmarks contrasted to your peers for financial savings and retired life. They'll examine short- and lasting objectives. What's helpful regarding this action is that it is customized for you.

You're young and functioning full-time, have a car or more and there are pupil car loans to settle. Here are some feasible concepts to aid: Develop excellent savings practices, repay debt, set baseline goals. Settle student lendings. Depending upon your occupation, you may qualify to have component of your school funding waived.

A Biased View of Clark Wealth Partners

You can go over the next finest time for follow-up. Prior to you begin, inquire about rates. Financial consultants generally have various tiers of prices. Some have minimum possession levels and will charge a cost commonly numerous thousand bucks for producing and readjusting a strategy, or they may charge a flat cost.

You're looking ahead to your retirement and aiding your youngsters with greater education costs. An economic advisor can offer suggestions for those situations and even more.

Clark Wealth Partners - An Overview

That may not be the most effective means to keep building riches, specifically as you progress in your job. Arrange normal check-ins with your organizer to modify your plan as needed. Balancing cost savings for retired life and university costs for your children can be difficult. A financial consultant can aid you focus on.

Thinking of when you can retire and what post-retirement years might look like can produce concerns concerning whether your retirement savings are in line with your post-work plans, or if you have saved enough to leave a heritage. Assist your monetary expert comprehend your technique to money. If you are extra conservative with conserving (and prospective loss), their pointers must reply to your fears and worries.

Clark Wealth Partners Can Be Fun For Anyone

Planning for health and wellness care is one of the big unknowns in retired life, and an economic specialist can outline options and suggest whether additional insurance as security might be practical. Prior to you start, attempt to obtain comfortable with the idea of sharing your entire economic image with a specialist.

Providing your specialist a complete image can assist them create a plan that's focused on to all components of your financial condition, particularly as you're quick approaching your post-work years. If your financial resources are basic and you have a love for doing it yourself, you might be fine on your very own.

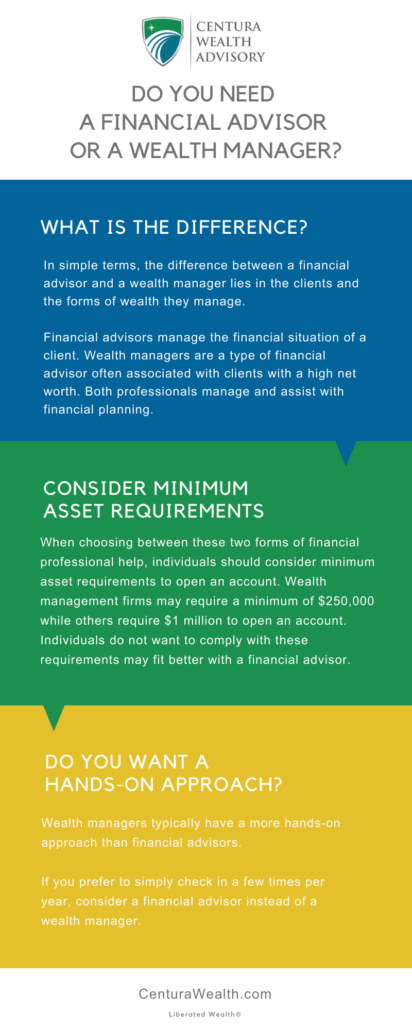

A financial advisor is not just for the super-rich; any person encountering significant life advice shifts, nearing retirement, or feeling bewildered by monetary decisions could gain from professional advice. This write-up discovers the role of monetary advisors, when you may need to seek advice from one, and vital considerations for selecting - https://experiment.com/users/clrkwlthprtnr. A financial advisor is a trained expert that aids clients handle their funds and make educated choices that align with their life goals

The Only Guide for Clark Wealth Partners

.jpeg?width=386&height=338&name=6%20Money%20Decisions%20Graphic%20(R).jpeg)

In comparison, commission-based advisors earn revenue via the financial products they offer, which might affect their suggestions. Whether it is marriage, divorce, the birth of a youngster, job adjustments, or the loss of a liked one, these occasions have distinct monetary effects, frequently calling for prompt decisions that can have lasting effects.